Grade Level

6 - 8

minutes

1-3 hours

subject

Mathematics

Activity Type:

interest rates, inflation, economical changes

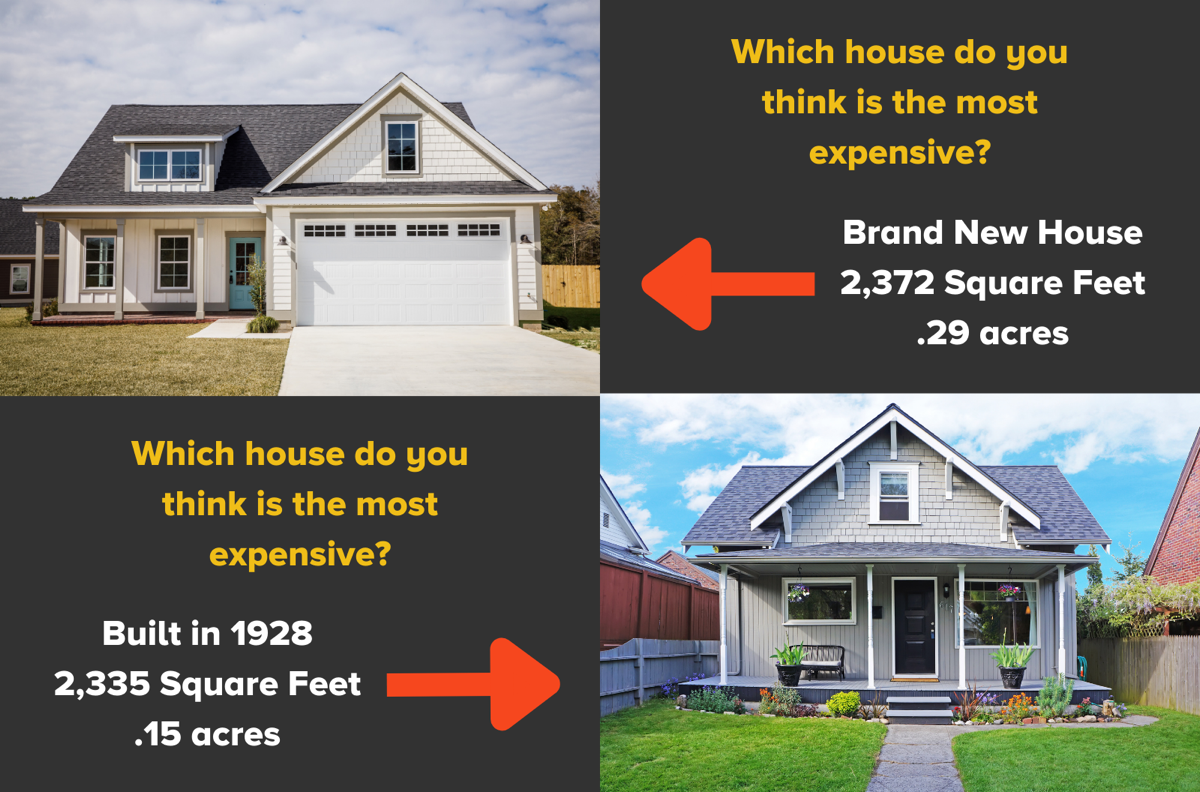

Look at these two houses. What do you notice about them? What are their similarities and differences? What questions come to mind when you look at them?

Purchasing your dream home is not just about how it looks and feels, but the actual costs associated with its size, characteristics, and location. Other factors, such as significant population growth in a community, financial market ups and downs, and even climate change can dramatically change not only the list price of a house, but also the total money you pay for the house with a loan and interest. Because so many different factors can affect the list price of the home, as well as the mortgage rate, it can be challenging to determine the actual cost of purchasing a home.

In this activity, you will calculate the mortgage costs for a new and old home. To do this, you will complete the following research and calculation tasks:

- Research the purchase costs of one old and one new home.

- Compute and compare the interest rates available.

- Research down payment percentages.

- Compare and reflect on the best financial decision based on the interest rates and down payment percentages you found.

Activity 1: Worked Example Mortgage Calculation

A mortgage is a type of loan that is used to purchase property with borrowed money from a financial institution, usually a bank, as the lender. Mortgages are initiated at the final purchase of a property and are repaid by the person(s) purchasing the property (the borrower) over an extended period of time. In addition to repaying the initial cost of the home (called the principle), the borrower has to pay additional money to the lender for providing the loan service. That additional money is called interest, and is determined by the total money borrowed and how long it will take to repay the full amount to the lender.

For most home buyers, the monthly mortgage payment is one of the most important numbers they use to determine if they have enough income to afford a home.

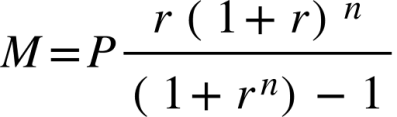

Here are some key terms that will help you learn how to calculate a monthly mortgage payment. Note the letter in parentheses next to some terms. These letters represent each term in our mortgage payment calculation formula below.

-

Mortgage payment equation: Monthly Payment = Principal loan amount multiplied by the monthly interest rate, divided by the quantity of (1 + monthly interest rate) raised to the power of the number of monthly payments, minus one. Purchase or list price: The listed price of a home at the time of sale.

- Down payment: The amount of money paid at the time of sale against the purchase or list price. The amount of a down payment that a person may provide is typically either reflective of a percentage or loan requirements. For example: Some lenders require 20% down payment (at closing) for a home loan before a loan can be considered (not necessarily approved). Additionally, there are loans available to different groups of people, such as the VA Home Loan which is for military veterans, that does not require any down payment.

- Principle (P): The amount of money borrowed to buy the house. This is usually the purchase price, minus the down payment.

- Interest rate: The annual interest rate is the added fee for the loan, and is an annual fraction of the total amount borrowed, usually described as an annual percentage rate (APR). A 5% interest rate, for example, is 5/100 = 0.05 of the total loan amount annually. An individual’s interest rate is based on two factors: the current interest rate determined by the Federal Open Market Committee and an individual’s credit score. A credit score is a calculated value that represents the likelihood that someone will pay back a loan, and is based on their history with other lenders, credit cards, and financial factors like student and car loans.

- Monthly interest rate (r): The monthly interest rate is the annual interest rate on a loan, divided by 12. In the above example, that’s 0.05/12 = 0.00417.

- Amortization: The length of time it will take with regular monthly payments for the mortgage to be paid in full. Often 10 years, 15 years, or 30 years. Notes that loans can be paid off early without penalty based on the terms listed provided by the lender.

- Number of payments (n): The total number of monthly payments in the mortgage period, equal to the amortization period in years, multiplied by 12 (e.g. 12 payments per year x 30 years = 360 payments)

- Monthly payment (M): The amount of money paid monthly, which is applied to both the principal and/or interest.

You will use the formula to calculate the overall mortgage costs of a home, starting with an example. We will start with a scenario where we already know all the mortgage terms, including the purchase price, down payment, interest rate, and repayment length of time (amortization). Below you’ll find a step-by-step guide for calculating a mortgage. For an overview and sample calculation, check out this video.

Using the scenario above with a purchase price of $671,000, it’s time for you and your group to find the total mortgage cost for purchasing a house based on the factors provided. You will have five to seven minutes to collaborate and calculate the total cost. When you are finished, analyze your results with one another and discuss the following questions:

- What did you learn from this lesson?

- How does calculating mortgage costs use percentages and equations?

- Look at the mortgage payment formula. What do you think would happen if we changed the length of the loan to be longer?

- Looking at the mortgage payment formula, what would happen if we increased the interest rate?

Now that you have learned how to compute the total cost of a mortgage given lender terms, let’s explore the effects that the changes in interest rates have on the total costs of purchasing a home.

Activity 2: Comparing Mortgage Costs

In addition to changing the sale price of a home, a number of factors can change the cost of a mortgage. You are going to practice calculating mortgage costs under different scenarios, such as with different down payment percentages and different interest rates. In this activity, you’ll compare the costs of purchasing a new home versus an older one that needs a little fixing up. This activity uses a mortgage rate calculator to make comparisons a bit speedier.

- Print or copy down the chart from the Mortgage Calculation Comparison Sheet in your notebook.

- Using this or another Mortgage Calculator, calculate the total cost of each mortgage scenario.

- Record your calculations in the chart of your engineering notebook.

Discuss as a group or with a partner the questions listed below, and be ready to share.

- What did you observe through this mortgage cost exploration activity?

- What did you notice about the total mortgage costs when your interest rate increased? Decreased?

- What occurred to your total mortgage costs when your down payment decreased?

- How do you think interest rates have changed over the years? Do you think they have consistently increased or decreased? Do you think there are factors, nationally or worldwide, that have affected interest rates?

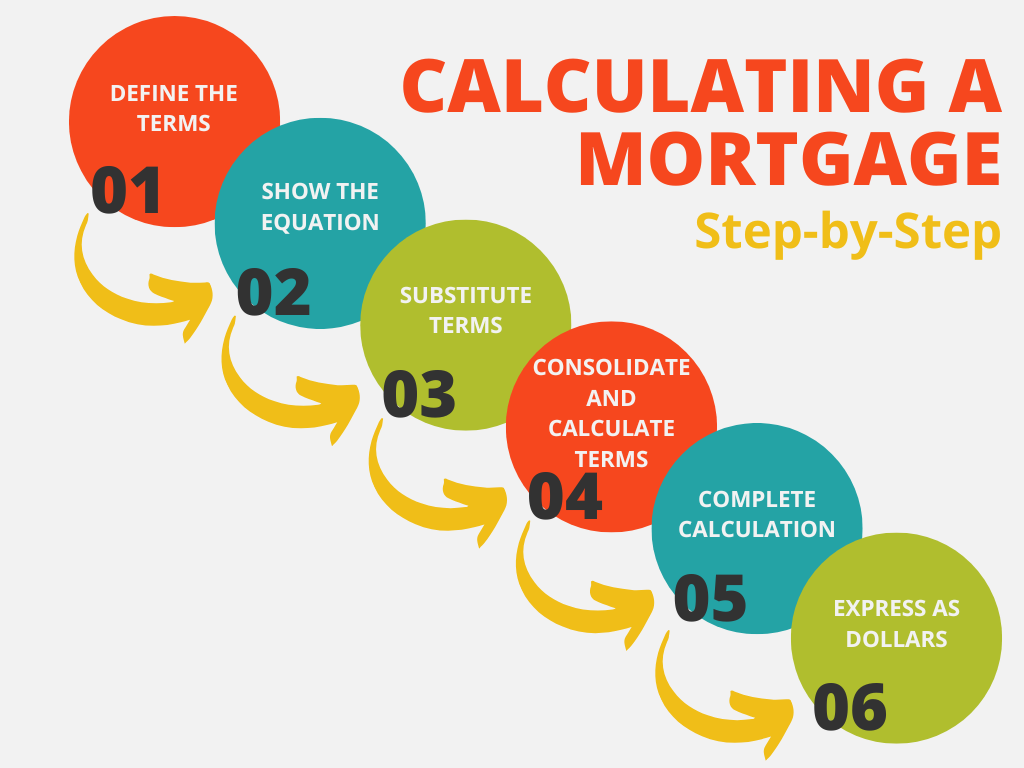

Activity 3: Mortgage Rate Changes

Now that we have initially seen how the total cost of purchasing a home is affected by interest rates and down payment percentages, let’s look deeper into the economical changes in the United States and the changes in interest rates for purchasing a home.

- Study the chart and identify two to three observations you made. Write one to three sentences in your notebook about your observations. What do you notice? What questions come to mind?

- Did you notice any significant changes over the years? What do you think caused those changes? Remember that interest rates typically go up when there is an economic downturn and there is a general concern that borrowers will not be as successful in paying off their loans.

- Do you have any reason to expect that our economy and housing market might return to the conditions, and therefore interest rates, of any of the times illustrated in the above graph?

- Most lenders offer a type of loan called a fixed-rate mortgage, which means that the interest rate never changes as the mortgage is being repaid. Why might that type of loan be advantageous on a 30-year mortgage? Looking at the above chart, in what years would it have been a bad idea to get a fixed-rate mortgage, and when do you think most home buyers might want one?

Activity 4: Calculate Your Dream Home’s Mortgage

Now that you have explored how mortgages work and the associated costs to having a mortgage, it’s time to calculate the mortgage costs of your dream home. Depending on the size of your home, your total mortgage costs will be different from your neighbors.

- You will need to pick and find the current price of your dream home for sale on one of the many available online search tools for finding a home, such as Zillow, Trulia, Realtor.com, RedFin, or a local realtor. Your dream home must be residential property (not commercial), have no more than three bedrooms and two bathrooms, and be located in your home state.

- Calculate your total mortgage cost, assuming that you have saved $60,000 for a downpayment and can get a 5.6% interest rate. In your notebook or using the Dream Home Mortgage Calculation Sheet, determine your total costs using the mortgage rate formula and the guides above to help you.

- Check your work using the mortgage rate calculator. Then, use the calculator to calculate your payments at 2.5% and 8% interest rates.

- Lastly, reflect on your findings. Write a three to five sentence reflection of your findings. Use this rubric to guide your reflection to ensure all expectations are met.

Activity 5: Percent Increase With Home Purchases Over Decades

As we continue to learn and grow in the understanding of purchasing a home and analyze the total costs associated with a significant financial responsibility, we must also be cognizant of factors that occur after the initial purchase of a home. Changes in our natural environment, including rising sea levels, increased flooding risk, and frequent damage due to severe weather events adds additional risk to a home buyer’s long term ability to maintain the home, pay a mortgage, or even to eventually sell their home.

The following stories describe homeowners who were forced to move, sell, or repeatedly repair their homes due to changing natural environments. Listen to or read one of the stories and answer each of the following questions in three to four sentences:

- What were some of the unforeseen costs, risks, or adversities the homeowners experienced that aren’t captured by a mortgage rate or a real estate listing?

- What information would have helped homebuyers avoid those risks? Is that information available?

- What risks can’t homebuyers avoid because sufficient information is unavailable?

First Homeowner Stories

- How Frequent Floods May Uproot Whole Neighborhoods

- The Climate Crisis Is Driving New Home Improvements

- As Seas Rise And Rivers Flood, Communities Look For A Way Out

- Planning For Spring Waters Along The Missouri

- After New Jersey Floods, Rebuild Or Retreat?

- With Worsening Wildfire Seasons, How Can We Learn To Live With Them?

CCCS Standards

- 6.EE.A.2: Write, read, and evaluate expressions in which letters stand for numbers.

- 6.EE.A.3: Apply the properties of operations to generate equivalent expressions.

- 7.EE.B.4: Use variables to represent quantities in a real-world or mathematical problem, and construct simple equations and inequalities to solve problems by reasoning about the quantities.

Credits

Lesson by Kristin Butkovich and Jamesa Broome

Copyediting by Gina Wadas and Ariel Zych

Digital Production by Sandy Roberts

Educator's Toolbox

Meet the Writers

About Kristin Butkovich

Kristin Butkovich is a 7th-grade STEAM math teacher at Richmond Hill Middle School in Richmond Hill, Georgia. Kristin’s continuous goal is to create a learning environment that embraces all students’ interests by guiding them through observing and learning of how math affects their current and future experiences in relation to our surrounding world.

About Jamesa Broome

Jamesa Broome is a Special education teacher at Richmond Hill Middle School in Georgia. She has cotaught math as a Special Education teacher, taught math remediation, regular math and advanced content math and was the 2019-2020 RHMS Teacher of the Year.